Rendez-vous VIP's du CEDRE Mardi 29 mars 2011 : "What's new in the American Franchise Industry" avec l'avocat américain Me Andrew Caffey

Quoi de neuf sur le marché américain de la franchise ?

LES RENDEZ-VOUS VIP DU CEDRE

MARDI 29 MARS 2011 THEME :

« « WHAT’S NEW IN THE AMERICAN FRANCHISE INDUSTRY» »

Animés par Olivier Gast, Président du CEDRE

MARDI 29 MARS 2011 THEME :

« « WHAT’S NEW IN THE AMERICAN FRANCHISE INDUSTRY» »

Animés par Olivier Gast, Président du CEDRE

| Guest star A l'occasion du passage à Paris du grand avocat américain de la franchise, Me Andrew Caffey (barreau de Washington DC), nous vous proposons de participer à « ce rendez-vous vip » du CEDRE. Ce rendez-vous s'adresse prioritairement, à ceux évidemment qui programment le développement de leurs enseignes aux USA. |

17h30 : Accueil des participants

17h45 : Introduction : Tous aux USA ! Pourquoi ?

Olivier Gast, Président du CEDRE

18h00 : Quoi de neuf sur le marché américain de la franchise ? : Master Franchise, Joint Venture, Corporate, Licensing, Filiale, Succursale...

- Faut-il d'abord s'implanter à New-York ?!

- Combien ça coûte de s'implanter aux USA ?

Me Andrew Caffey, Avocat à Washington DC, spécialiste américain de la franchise

19h00 : Table ronde : Les pièges à éviter sur le marché américain

Animée par Me Gilles Menguy, Avocat & Solicitor, Gast & Menguy et Me Andrew Caffey

20h00 : Conclusion et cocktail

Les « RDV’s VIP du CEDRE» du mardi 29 mars 2011 ont reçu l’avocat de Washington DC, Me Andrew Caffey. Son exposé sur la façon d’aborder le marché américain de la franchise ont convaincu les participants, tous ayant déjà un pied sur le marché américain, de ne pas considérer les lois américaines sur la franchise comme insurmontables, bien au contraire, considérant l’énorme marché qu’il représente !!! Les Boulangeries Paul, Mezzo di Pasta, Nooï, Expence Reduction Analyst, prendront certainement Me Caffey comme conseil !!!... L’avantage des RDV’s VIP du CEDRE réside dans le fait que les thèmes sont extrêmement ciblés et que seuls les initiés répondent présents…

Olivier Gast Président du CEDRE

Olivier Gast Président du CEDRE

________________________________________________________________________________________

Plan détaillé de l'Intervention de Me Andrew A. Caffey

________________________________________________________________________________________

Le compte-rendu technique version anglaise

FRANCHISING IN THE UNITED STATES

Andrew CAFFEY, CEDRE conference, March 29th 2011

The American definition of franchising differs from the French one in the way that the Amended FTC Rule does not refer to the existence of the Know-How as a requirement: “As under the original Rule, a commercial business arrangement is a franchise if it satisfies the three definitional elements. Specifically, the franchisor must (1) promise to provide a trademark or other commercial symbol; (2) promise to exercise significant control or provide significant assistance in the operation of the business; and (3) require a minimum payment of at least $500 during the first six months of operations.”

An overview in figures

The business of franchising in the US is a huge portion of its economy, and now is an “excellent time to be approaching the US market “ said A. CAFFEY, renowned franchise lawyer established in Bethesda, Maryland and former General Counsel of the International Franchise Association. In 2007 there were 828 138 franchised business establishments in the U which accounted for 9.1 million jobs and $468.5 billion of the US Gross Domestic Products. Franchising amounts to 6.2% of the Nonfarm Private Sector of the US economy. The financial crisis has affected every sphere of the US economy and recovery is painfully slow. Credit is still very tight and franchising initiatives have seemed to lager in the past 3 years. But “optimism is a must” underlines lawyer Caffey and reports have shown that franchising business is increasing again.

Legal framework

On a federal level, there are some national standards imposed by the Federal Trade Commission (FTC). As of July 1, 2008, all franchisors must prepare and distribute disclosure documents that, at a minimum, comply with the disclosure format of the Amended FTC Franchise Rule, which shall include in particular a description of the offering, a sample copy of the franchise agreement to be signed, initial investments needed from the franchisee and financial disclosure. The new regulations have had a beneficial effect on the legal framework of franchise in the US: more uniformity in disclosure documents since the federal format is mostly followed by the states and has allowed electronic disclosure over the internet, by email, on disk... The disclosure document can now be posted on the company’s website and accessible to any prospect franchisee.

Under the Amended FTC Franchise Rule, states may impose additional requirements and steps to be taken by the franchisor under state law consistent with the Amended FTC Franchise Rule. Registration obligation is the most significant one. There are 14 franchise registration states in the United States: California, Hawaii, Illinois, Indiana, Maryland, Michigan, Minnesota, North Dakota, New York, Oregon, Rhode Island, South Dakota, Virginia, Washington and Wisconsin. When looking into implementing a franchise business in the US, the first reflex should be to check for any legal requirement in the considered state, and such should underpin a business strategy as Andrew Caffey notes. Registration is a pre requisite in those 14 states and imposes:

- Approval by the state officials of the Franchise Disclosure Document (FDD) prior to any information to be given out about the franchise business. No information brochure, no presentation, no discussion, not even a phone conversation can be exchanged on the franchise project if the business is not registered. State laws are very strict on that matter.

- Registration fees have to be payed to the state regulatory agencies which amount varies depending on the states, the cheapest being Hawaii ($125) and the most expensive one being New York ($750).

- Approval by the state officials of the Franchise Disclosure Document (FDD) prior to any information to be given out about the franchise business. No information brochure, no presentation, no discussion, not even a phone conversation can be exchanged on the franchise project if the business is not registered. State laws are very strict on that matter.

- Registration fees have to be payed to the state regulatory agencies which amount varies depending on the states, the cheapest being Hawaii ($125) and the most expensive one being New York ($750).

Thanks to the key changes in the Amended FTC Rule, the franchise legal atmosphere has improved in the States and has eased the way for French franchisors. There are some notable advantages for foreign companies wishing to develop a franchise business in the US. Indeed, the Amended FTC provides 3 exemptions which enables them to avoid the franchise disclosure process altogether:

1. The “sophisticated investors” requirement applies to companies that have been in the business for at least 5 year and have a net worth of at least $5 million.

2. Franchises requiring investments exceeding $1 million.

3. Franchises sold to officers, owners or managers of a franchise system whom have been employed by the franchise company for at least two years before purchasing the franchise.

1. The “sophisticated investors” requirement applies to companies that have been in the business for at least 5 year and have a net worth of at least $5 million.

2. Franchises requiring investments exceeding $1 million.

3. Franchises sold to officers, owners or managers of a franchise system whom have been employed by the franchise company for at least two years before purchasing the franchise.

Dispute resolution

“The US is a very litigious country” underlines M. Caffey, author of Stay Out of Court! The Small Business Guide to Preventing Disputes and Avoiding Lawsuit Hell. Whereas going to court is mostly reserved for Trademark disputes, arbitration and mediation are two efficient ways to deal with litigation in franchising.

Including an arbitration clause in a franchise agreement will allow a fast, cheap and convenient (the choice of the location of the arbitration is permitted) way to resolve conflicts arising from the relationship between the franchisor and the franchisee. 44% of all franchise agreements require binding arbitration and 85% refer to the American Arbitration Association to administer the arbitration process. Mediation is another mean of dealing with litigation. It is effective and ensures a resolution of the conflict in 85% of cases. If mediation fails, arbitration is to be considered.

Including an arbitration clause in a franchise agreement will allow a fast, cheap and convenient (the choice of the location of the arbitration is permitted) way to resolve conflicts arising from the relationship between the franchisor and the franchisee. 44% of all franchise agreements require binding arbitration and 85% refer to the American Arbitration Association to administer the arbitration process. Mediation is another mean of dealing with litigation. It is effective and ensures a resolution of the conflict in 85% of cases. If mediation fails, arbitration is to be considered.

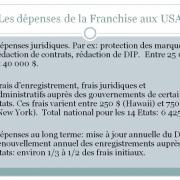

Expenses of US franchising

There three main points which will require the most investments are:

1. Legal expenses which include the creation of contracts, the registration of the trademarks and the creation of the FDD ( from $25.000 to $40.000 depending on the working style of the company since these steps require a huge amount of information from franchisor)

2. State Registration Filling Fees as well as legal fees and charges by states government. The total amount for registration in the 14 states is $6.425.

3. Continuing expenses which refer to the annual update of the FDD and the annual renewal of state registration fillings, the total of which amounts to approximatively 1/3 to 1/2 of the initial expenses.

1. Legal expenses which include the creation of contracts, the registration of the trademarks and the creation of the FDD ( from $25.000 to $40.000 depending on the working style of the company since these steps require a huge amount of information from franchisor)

2. State Registration Filling Fees as well as legal fees and charges by states government. The total amount for registration in the 14 states is $6.425.

3. Continuing expenses which refer to the annual update of the FDD and the annual renewal of state registration fillings, the total of which amounts to approximatively 1/3 to 1/2 of the initial expenses.

In a nutshell, the US is a major market with unlimited growth potential and an enormous territory. The challenge is big, yet with the right strategic approach and the legal advisor, the franchise laws and regulations procedures are manageable.

LE CEDRE

"Découvrez mes

"Découvrez mes